By A. Jeyaraj

Financing Affordable Housing: Moving towards inclusive development, was a research paper presented by Professor Ahamed Kameel Mydin Meera, Managing Director, Z Consulting Group at the 4th IDR Annual Research Seminar held at Impiana Hotel recently.

Many young couples are finding that buying a house is beyond their financial means. Affordable houses is an interesting topic and Professor Ahamed gave examples from other countries on how they have solved the problem.

Housing is one of the most basic necessities and price of homes have skyrocketed, especially for those living in urban areas.

In the Malaysian context, the affordability standards in the public housing sector are based on the Housing Price to Income Ratio (PIR). The housing price is unaffordable if PIR exceeds three times of the median gross annual household income.

The average prices of houses in all states were given and the figures for Perak had an Affordability Criteria of 4.1 to 5.0 which is seriously unaffordable.

Professor Ahamed discussed the Singapore Model of Housing and Development Board (HDB) as follows:

- About 80% of Singaporeans live in subsidised public housing built by HDB.

- The homes are leased out to ‘buyers’.

- Prices of new properties are controlled by the government.

The following proposal by Professor Ahamed is:

- To identify problems plaguing current homeowners and potential buyers in terms of financing options and availability.

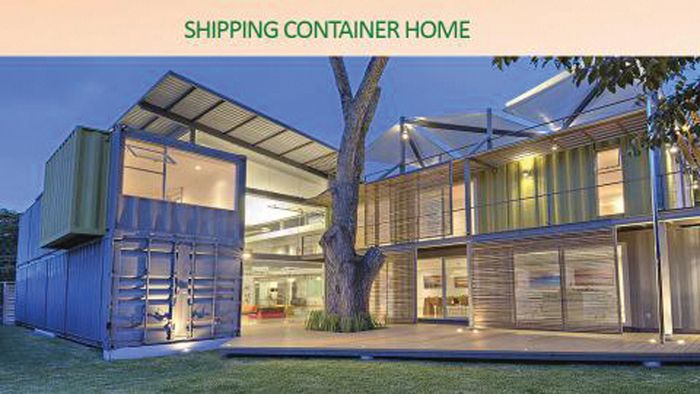

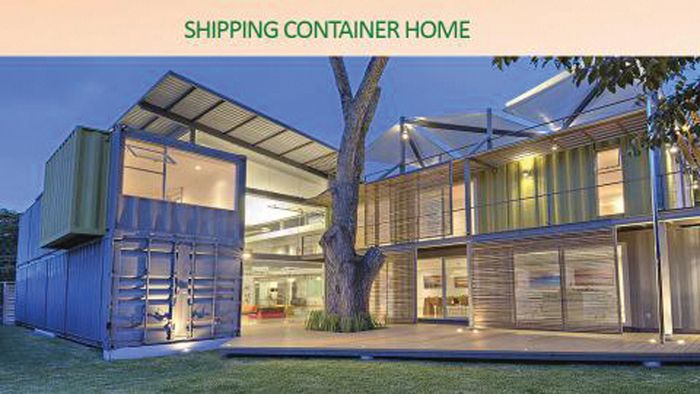

- To identify efficient and cost effective methods of constructing affordable homes using as much local resources available.

- To identify financing methods (Islamic) that make it possible for home ownership in a shorter period of time.

- Lobby for public interest vs developers’ interest.

- To be a one-stop agency for the development of affordable home – eliminate bureaucracy and obstacles that increase the cost of houses.

The Financing Options are:

- Housing Co-operative

- Canadian Model – Ansar Housing Co-operative

- Family Co-operative – Members come together, buy land together, can take financing from Suruhanjaya Koperasi Malaysia (SKM) and develop together.

PROJECT 1: Dana Perumahan Perak

- To tap into internationally available funds at cheap costs to finance purchase of affordable homes by Perakians.

- To make funds available to those who cannot get funds from the banking sector.

PROJECT 2: Establish an Islamic Housing Co-operative

- Objective is to establish an Islamic Housing Co-operative modelled after Ansar Islamic Housing Co-operative Corporation of Toronto, Canada.

- Objective is to provide home financing using Musharakah Mutanaqisah contract where members can own home within 15 years.

- Co-operative can also build homes to cut further construction costs and to generate additional income for members.

Benefits of setting up an Housing Institute

- Minister is patron to the institute – officiates the annual conference and other events. Good international exposure and networking. Excellent goodwill.

- Able to address an important issue facing the people. People own home in a short period – Political mileage.

- Gradually solve the affordable housing issue.

Benefits

- Overcome current housing crisis

- Political Mileage for Government

From the reporter’s perspective I recall that during the 3rd IDR Seminar held last year there was also a research paper presented on Housing and each participant was given a copy of the book ‘Making Housing Affordable’, published by Khazanah Research Institute. During that presentation we were informed that affordable houses are built in the Philippines.

Money and time is being spent on finding ways to build affordable houses and how to finance them and I am sure the government of the day is aware of it. I do not understand why the government has no will power to take action. There is lot of talk, but no action.

“When other countries can build affordable homes, why not we.”