What comes to mind when you hear the word ‘shopaholic’? A woman with multiple shopping bags filled with branded clothes and shoes who is always on the phone?

Well, it is about time we change that common image as we shed light on shopping addiction, also known as compulsive buying disorder.

Many are finding it difficult to resist overspending on superfluous things. Be it extra clothes, accessories or shoes. And here’s why.

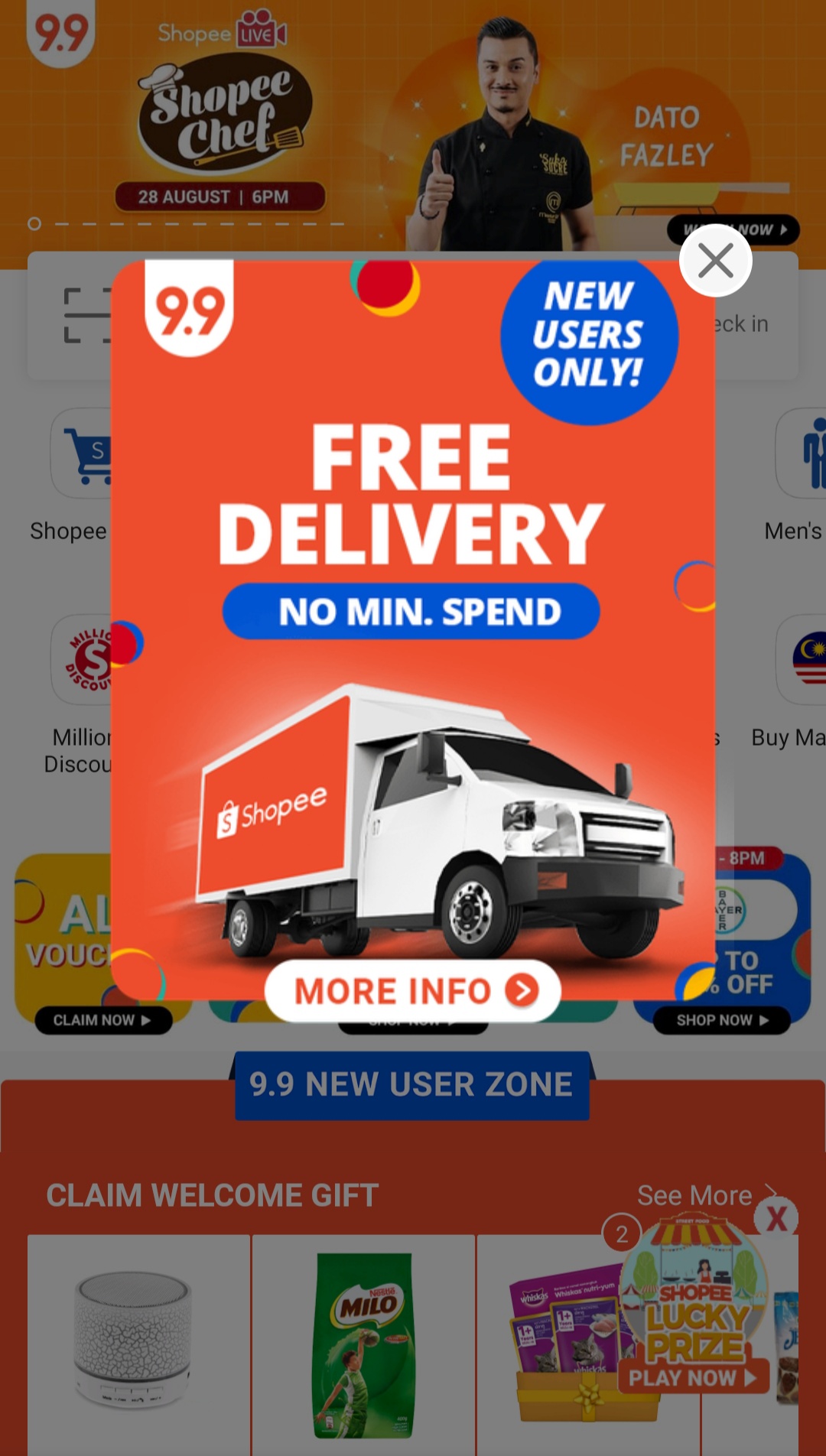

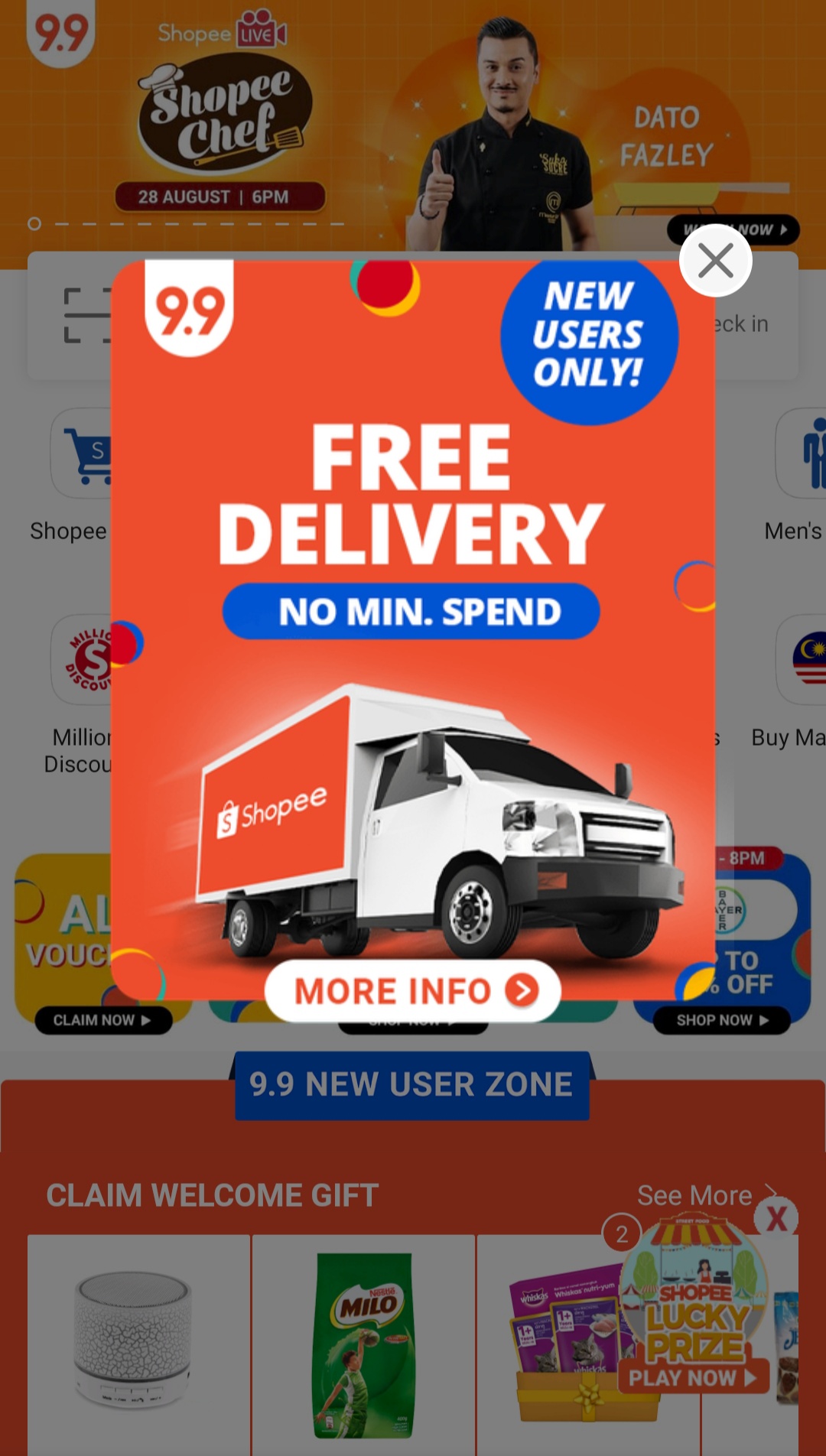

“Shopping delivers instant gratification for impulse buyers. For example, when you see others getting on the 9.9 sale, you might also succumb to the temptation,” a 29-year-old who admitted to impulse buy sometimes. It shows that sometimes impulse buying could be motivated by peer influence.

A recent study suggests that impulse purchases are motivated by several reasons: enjoyment, thinking you have spotted a bargain, the need to stockpile and emotional appeal.

Additionally, people who are susceptible to stress or have impulse control issues in general are also more likely to impulse buy as a means of managing their stress. For others, impulse buying may be an attempt at coping with feelings of being incomplete or being imperfect.

Fortunately, there are steps you can take to reduce impulse buying. First things first, get your priorities in line. Let’s not forget that we all have commitments: education loans, car installments, living expenses, accommodation, etc. And all of that needs to be taken care of before considering making other purchases.

Yet despite being under tight financial constraints, some of us are still shopping recklessly to satisfy our guilty pleasure, which is unhealthy. Just don’t live beyond your means, otherwise it may land you with huge debts in the long run.

Does retail therapy actually work?

In the book, ‘Retail Therapy: Bad Habit or Mood Booster’ by Crystal Raypole, who has previously worked as a writer and editor for Good Therapy, retail therapy does chase the blues away.

However, Medical Advisor Timothy J. Legg, a geriatric and psychiatric mental health nurse practitioner explained that, “If you consistently use shopping to cope with distress, it can become a less-than-ideal way of dealing with what’s troubling you, whether that’s a huge assignment at work or serious issues in your relationship. The temporary mood boost associated with shopping can prevent you from seeking help that would offer more significant, long-lasting benefits.”

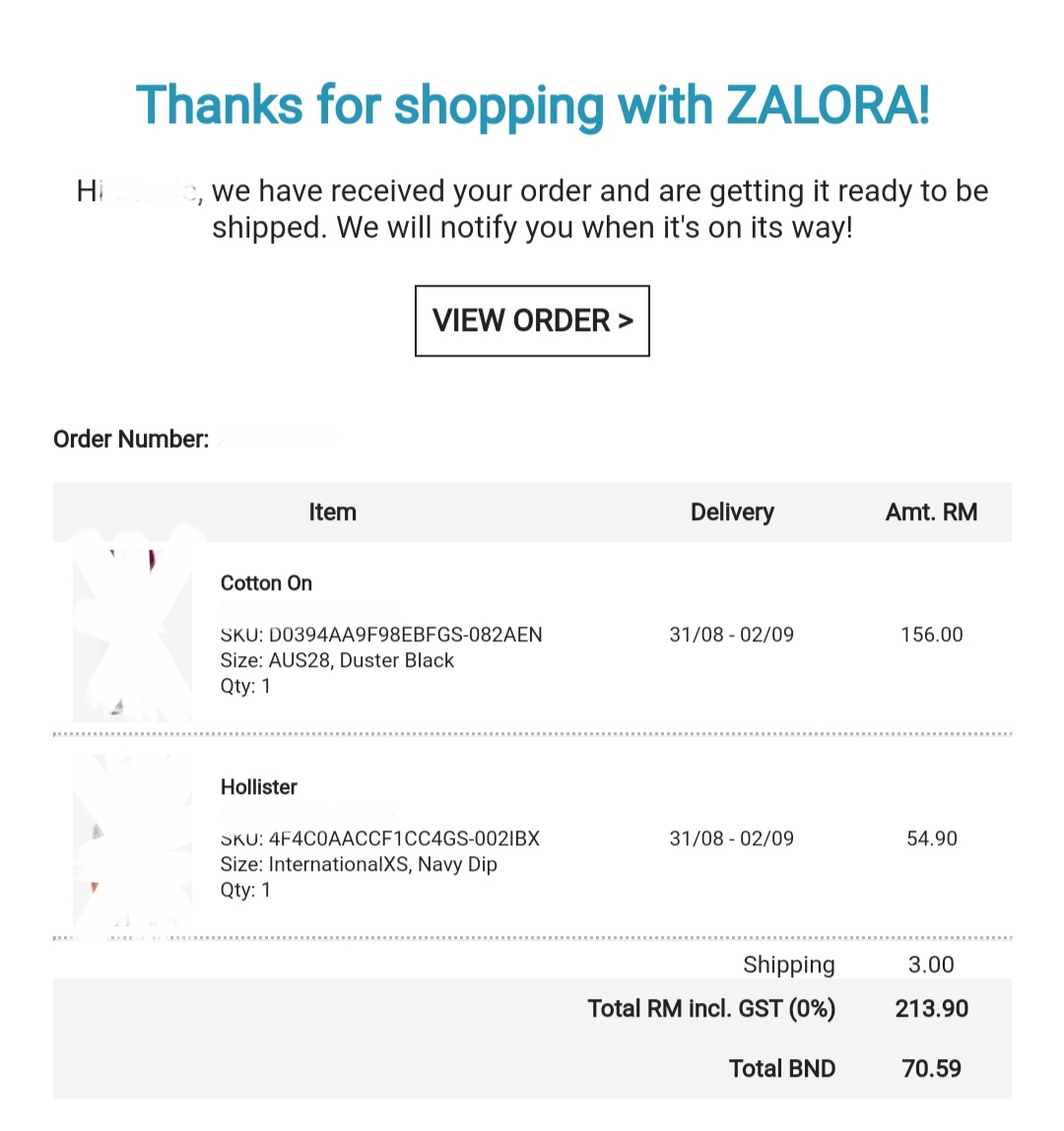

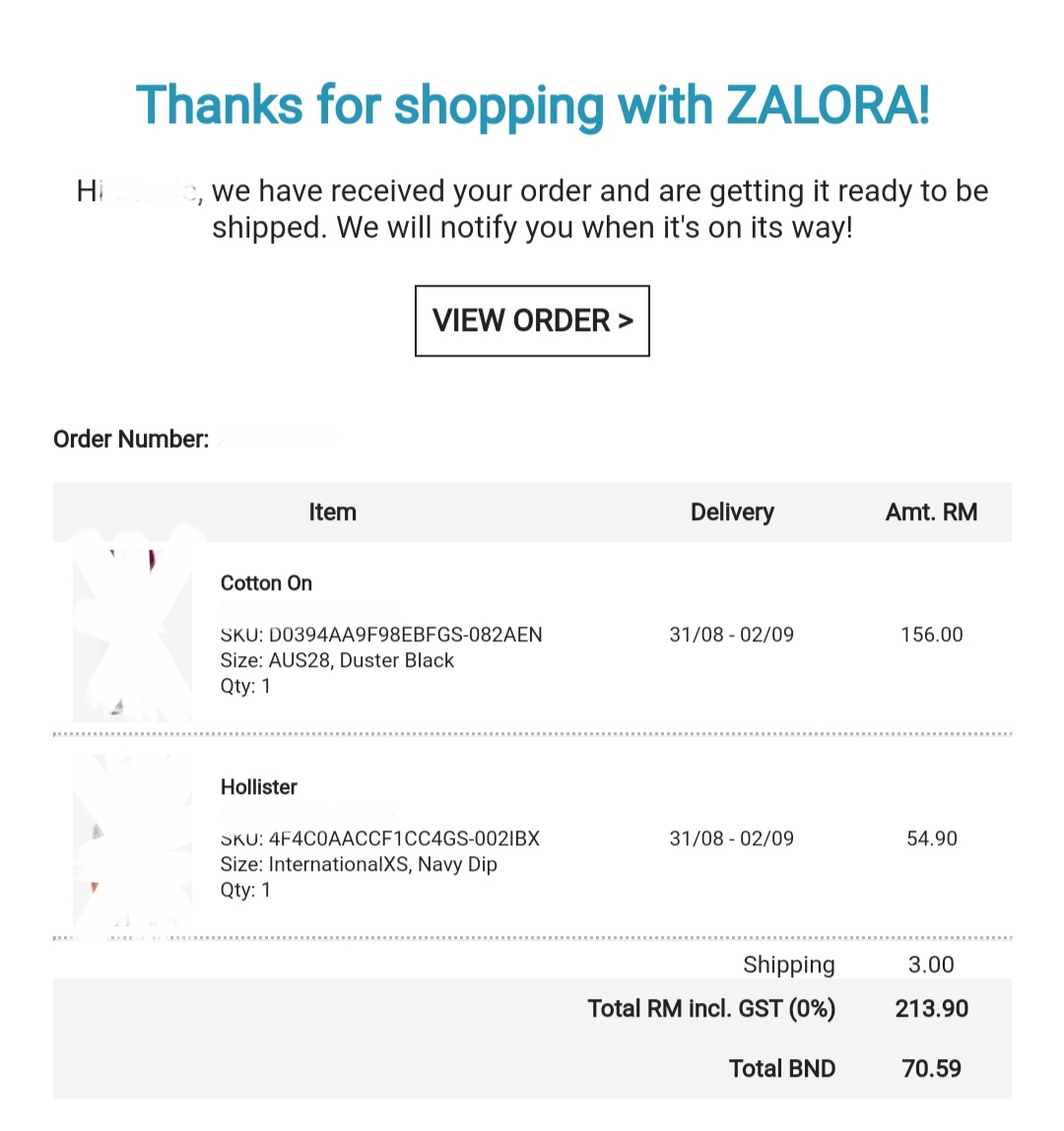

“Buying clothes is mentally satisfying. I’d usually add my favourite ones into the cart or wishlist and purchase them on the first of every month (almost).

“Although the clothes are never more than RM150, the regret is starting to kick in, I’m riddled by guilt,” Karyn, a shopping addict sighed.

She suggested that one way to continue buying the things we like without overspending is to set a spending budget and follow through.

Children do what feels good, Adults devise a plan and follow it – Dave Ramsey, author, businessman and American radio show host

A twenty-five-year-old Ipohite who is currently studying law expressed that, “It’s no wonder that more and more people opt for online shopping, it’s effortless and easily accessible.

A twenty-seven-year-old journalist posited that money should be used to buy needed items, not desired items. “First off, determine if the item is more desired or more needed. Online shopping apps like Lazada and Shopee? Uninstall them when a purchase is finalised or delivered to your home. After all, these apps will constantly lure people to spend more,” he said.

One important highlight in Dave Ramsey’s article on ‘Impulse Buying: Why We Do It and How To Stop’ is to shop with a plan in mind. If one plans what they are going to buy, the chances of overspending are minimised.

The excitement of purchasing something unexpectedly is tempting, but unfortunately the ecstasy never lasts! Just because your favourite shirt is being sold at a bargain doesn’t mean you have to immediately hand over your money.

Gisele Soo