EconomyFeaturedGovernmentNationNEWS

Initiatives under PENJANA

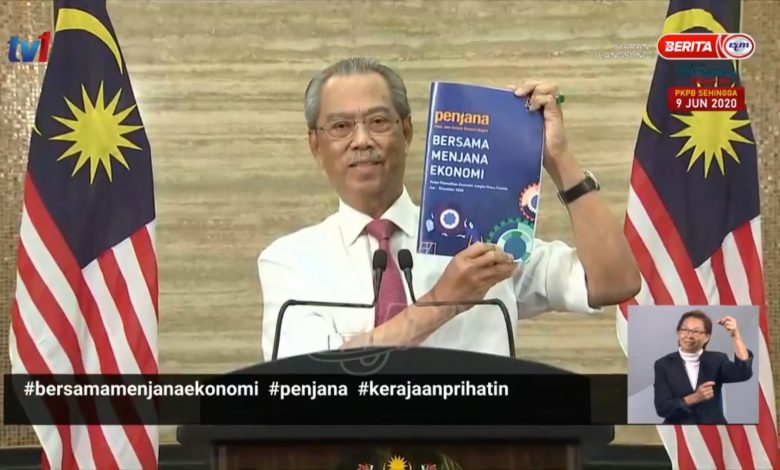

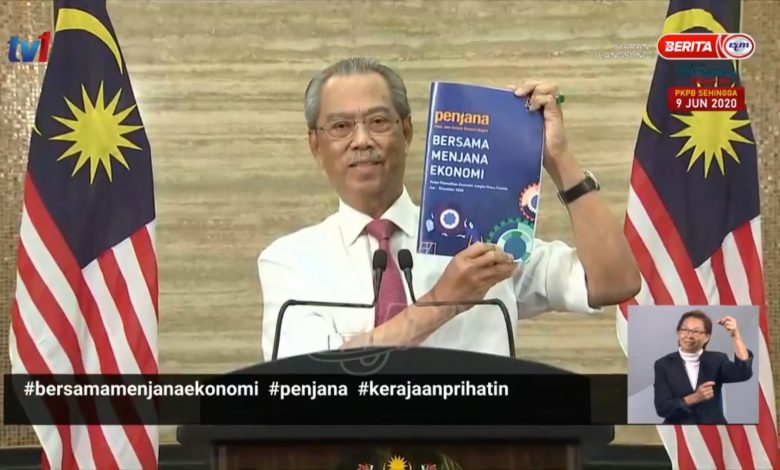

Here’s a summary of the initiatives under the National Economic Recovery Plan (PENJANA) which focus on 3 key cores elements- empower people, propel businesses and stimulate the economy in the new normal – as announced by Prime Minister Tan Sri Muhyiddin Yassin in his televised address today:

Empower People

- The wage subsidy programme will be extended for a further three months with subsidy of RM600 per employee for all eligible employers

- Enhancement of the PERKESO job portal and employment placement services

- Incentives will be introduced to encourage the hiring of the unemployed including the youth and the differently abled

- A RM2 billion fund will be dedicated to reskilling and upskilling programmes for youth and unemployed workers

- Policies will be facilitated to support the growth of the gig economy and the welfare of gig economy workers

- To sustain the new normal of work-from-home, there will be further tax deduction for employers, individual income tax exemption to employees and special individual income tax relief

- To ease the transition to the new normal of working-from-home, the Government will support working parents through the subsidy of child care expenses, incentives to encourage child care centres to comply with the new normal and incentivising certification of early education practitioners

- An unlimited monthly travel pass costing RM30 for use on all rail services (MRT, LRT, Monorail), BRT, RapidKL buses and MRT feeder buses will be introduced

- Social assistance support will be provided to identified vulnerable groups including registered OKUs, single mothers and volunteer home help services besides grant for relevant registered NGOs which support vulnerable groups

- The government will double the existing allocation for the PEKA B40 Programme to a total of RM100 million in order to fund four benefits for the B40 group: health screening, medical device assistance, cancer treatment incentives and subsidy for transportation for health

- Internet connectivity: Free 1Gb per day between 8am to 6pm for education, productivity (video conference applications) and news by participating telecommunication companies

Propel Businesses

- Eligible micro enterprises and SMEs will be encouraged to shift towards business digitalisation through a co-funded programme with MDEC and e-commerce platforms.

- The Government will collaborate with e-commerce platforms to co-fund digital discount vouchers to encourage online spending on products from local retailers

- The Government will continue to provide grants and loans to eligible enterprises for adoption or subscription of digitalisation services

- An online one-stop business advisory platform for the Micro enterprises and SMEs will be set up to enhance the outreach of the existing physical SME Hub

- The banking sector will offer an additional RM2 billion of funding to assist SMEs adversely impacted by COVID-19 sustain business operations at a concession rate of 3.5%

- To aid the tourism sector, a RM1 billion PENJANA Tourism Financing (PTF) facility will be made available to finance transformation initiatives by SMEs in the tourism sector to enable them to remain viable and competitive in the new normal. Details of this fund will be announced in July 2020

- New funding program for SMEs and micro enterprises at a subsidised interest rate of 3.5%, aggregated approved financing will be capped at RM50,000 per enterprise and RM50 million is earmarked for women entrepreneurs

- PUNB will provide RM200 million dedicated financial assistance for Bumiputera owned shariah compliant businesses

- SME Bank will provide financing support to contractors and vendors who were awarded with small government projects

- To provide relief to SMEs’ cash flows, the Government is encouraging GLCs and large corporations to accelerate their vendors’ payment terms

- Extend the period and expand the scope of expenses allowed as tax deduction or capital allowance for COVID-19’s prevention, including COVID-19 testing and purchase of PPE and thermal scanners

- 50% remission of penalty for late payment of sales tax & service tax due and payable from 1st July 2020 to 30th September 2020

- Provide a matching grant through Malaysian Global Innovation & Creativity Centre (MaGIC) totaling RM10 million to social enterprises who are able to crowdsource contributions and donations to undertake social projects that will address the challenges faced by targeted communities through innovative ways

- To catalyse establishment of new businesses, financial relief will be provided in the form of income tax rebate for newly established SME and stamp duty exemption for SMEs on any instruments executed for Mergers and Acquisitions (M&As)

Stimulate the Economy

- An investment fund will be established, which will match institutional private capital investment with selected venture capital and early stage tech fund managers. (International investors and venture capital funds that have expressed interest include SK Group, Hanwha Asset Management, KB Investment Co. Ltd, Provident Growth, 500 Startups and The Hive)

- An innovation sandbox will be developed to pilot new technology solutions and provide relaxation of regulations in order to test new technology solutions

- Accelerate the digitalisation of government services to reduce face-to-face transactions

- National “Buy Malaysia” Campaign to encourage the consumption of Malaysian-made products and services

- Encourage contact-free payment through the provision of RM50 worth of e-wallet credits and additional RM50 in value through vouchers, cashback and discounts by e-wallets (applicable to all Malaysians aged 18 and above and earning less than RM100,000 annually)

- Tax exemption for purchase of properties: Home Ownership Campaign (HOC) to be reintroduced

- Tax exemption for purchase of passenger cars: full sales tax exemption on locally assembled cars and 50% sales tax exemption on imported cars

- Encourage transition away from the traditional working hours concept of 9am to 5pm towards extended working hours on shifts-basis. Government to lead the way beginning with new operating hours for the Urban Transformation Centres (UTC) and Health Clinics

- Tax incentives for company relocating into Malaysia

- Tax incentives for the tourism sector: tourism tax exemption, extension of service tax exemption for hotels among others

- Dedicated funding and support for the arts, culture, entertainment, events and exhibitions sector: RM100 million in soft loans with interest rate of 3.5% and RM30 million in grants for the creative, events and exhibitions industries under MyCreative Ventures and RM10 million for CENDANA

- Financial relief for agriculture and food players: micro credit financing under Agrobank for agropreneurs totalling RM350 million with interest rate of 3.5%

- Support the commodity sector through 100% export duty exemption from 1 July 2020 to 31 December 2020 (crude palm oil, crude palm kernel oil and refined bleached deodorized palm kernel oil)

- Introduction of COVID-19 Temporary Measures Act to minimise disruption to social and economic well-being

- To enable the Rakyat to join the Government in supporting post recovery measures, MOF will issue an Islamic debt instrument, the Sukuk Prihatin

For more details, readers can visit the website of Ministry of Finance at www.treasury.gov.my