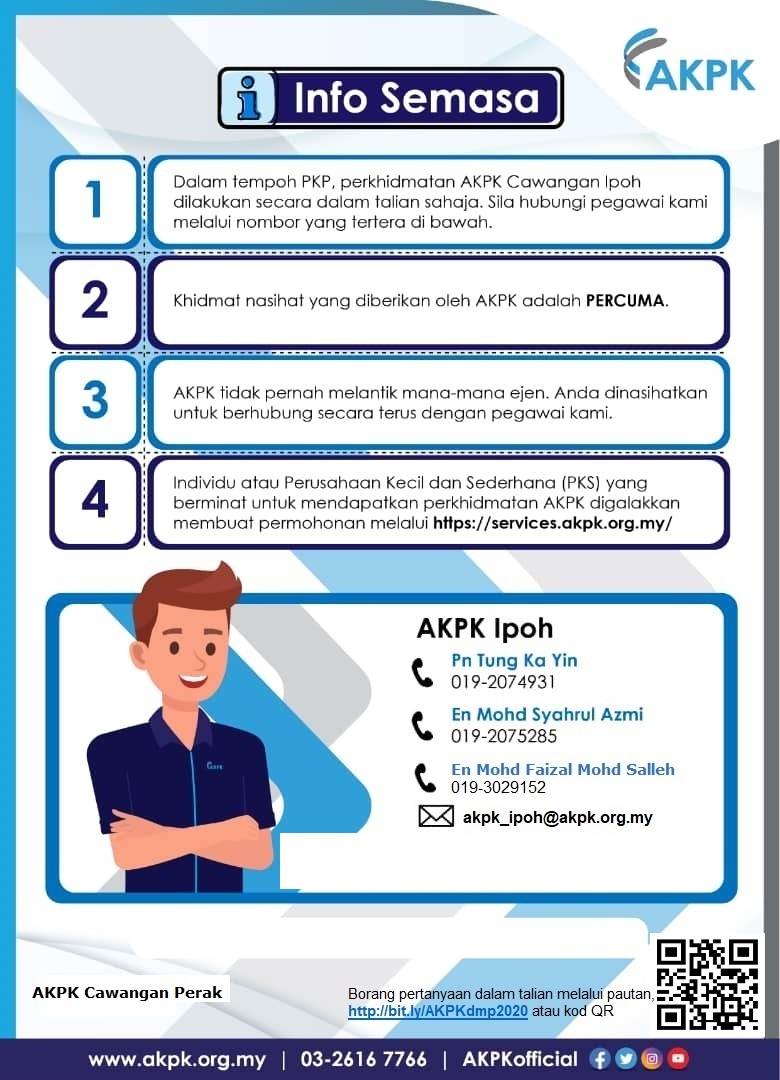

Public Misconceptions about AKPK

There exist certain public misconceptions about the Credit Counselling and Debt Management Agency (AKPK), an agency set up by Bank Negara Malaysia in April 2006 to help individuals take control of their financial situation and gain peace of mind that comes from the wise use of credit.

This article highlights the seven common misconceptions that the public may have and addresses them one by one in order to provide a clearer picture and promote deeper understanding on the features of AKPK’s Debt Management Programme (DMP).

#1 A lot of people think that by enrolling into AKPK’s Debt Management Programme (DMP), their status is equivalent to being bankrupt.

This is not true. AKPK is your financial friend. AKPK represents borrowers to discuss with credit providers or financial institutions for a personalized debt repayment plan through the restructuring of the borrowers’ debts in line with their cash flow or repayment capacity.

Borrowers may enjoy several benefits such as moratorium of legal action and not being declared bankrupt, exemption on stamp duty agreement (if any), cessation of collection action by the debt collection agency and access to a one stop payment centre via AKPK.

#2 Borrowers have the perception that they will be blacklisted once enrolled into AKPK’s DMP.

We encourage borrowers to resolve the issues one by one, that is, reduce the existing accumulated debt before incurring new debt.

AKPK never blacklists borrowers nor does it have the power to block any loan application. Obtaining new credit while enrolled in DMP is subject to Financial Service Providers’ discretion. On the contrary, AKPK assists borrowers to repair their credit score and increase their possibility to get their loan application approved in the future.

#3 Why is it that borrowers can no longer use their credit card once enrolled into DMP?

Let’s repair your finances first. Learn how to control your spending and manage your debt well. Consumers can use credit cards after the end of the DMP tenure since they are more adept in managing their debts and controlling their expenses.

Based on our statistics, credit cards constitute the highest facility being restructured via DMP. Borrowers fall into the trap of unmanageable debt when they cannot settle their credit card debts and only pay a minimum amount every month. Their spending or expenses are not in line with their affordability and income.

#4 Existence of stigma being associated with AKPK due to the public’s perception.

There should not be any stigma associated with AKPK. A borrower may be in denial. He may feel that the people around him harbour negative perceptions about him and assume that the problem is still under control when it may be getting worse.

It will greatly affect the borrower if he experiences disturbance from a collection agency due to unpaid debt and the people around him get to know about it as well. We need to manage our debt before it spirals out of control. Prompt action is the key. We encourage borrowers and the public to get help early.

#5 AKPK provides loans to borrowers to pay off their debt.

AKPK does not provide any loans to borrowers to pay off their debts with banks. We provide assistance and advisory services to borrowers who have debt repayment problems through the Debt Management Programme (DMP).

DMP is a personalised debt repayment plan for individual customers developed in consultation and agreement with the banks involved. AKPK will negotiate with banks to get the best solution for borrowers and if an agreement is reached, the debts can be repaid via the agreed instalment amount based on each borrower’s capacity.

#6 AKPK charges some fee for its services.

AKPK’s services are provided free of charge to individuals and SMEs. AKPK does not elect any third party agent for our services. The public should be careful and stay vigilant against financial scams or unscrupulous people especially during such challenging times.

#7 AKPK can assist to resolve all kinds of borrower’s debt.

AKPK’s services are only available for borrowers with loans from credit providers approved by Bank Negara Malaysia and others providers who have joined our list such as PTPTN, AEON Credit, Tekun, Koperasi Ukhwah and Aiqon Capital. AKPK’s DMP aims to assist borrowers to achieve peace of mind through better cash flow for living purposes and managed debts.

AKPK does not appoint any third party agent and its services are free of charge. Do not easily fall for any financial scams out there which are rampant at this challenging time. Do visit its official website www.akpk.org.my for more information. Follow AKPK’s Official Facebook and Instagram for latest updates and follow #DMPtaksusahpon for more information on DMP. You may submit your enquiries or access AKPK’s services online via https://services.akpk.org.my, after which AKPK financial advisors will get in touch with you.

===========================

Get your local news fast. Download the Ipoh Echo App on your mobile. Available on both Google Playstore and Apple Appstore.