Cover Story

By Emily Lowe

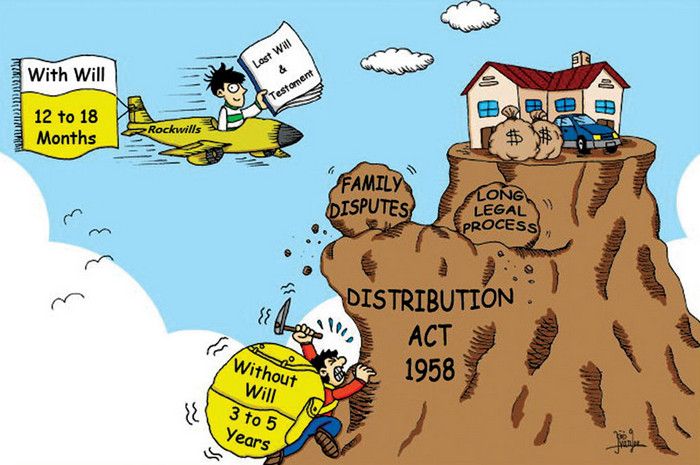

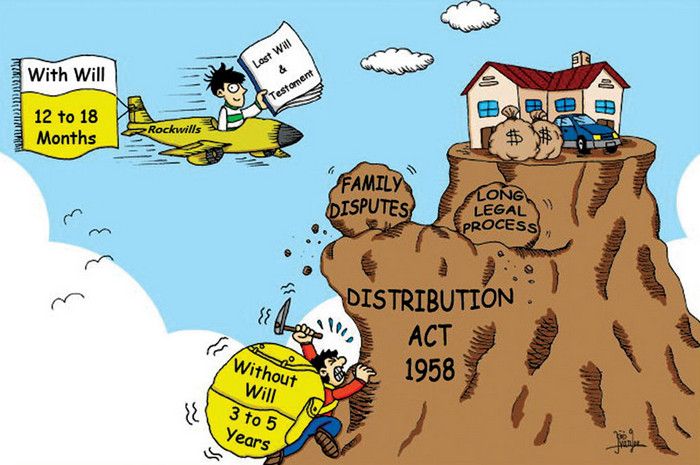

But how many of us plan for the smooth distribution of wealth to our beneficiaries upon our demise? To date, unclaimed monies and frozen assets in Malaysia amount to over RM60 billion. Procrastination is one of the main reasons why most of us still do not have a will drawn up.

Ipoh Echo spoke to Peter Lee, an estate planner of Rockwills in Ipoh, about will and estate planning. Peter has more than ten years of experience in this field.

Dying Intestate or Dying Without a Will

Under the Distribution Act 1958 (amended 1997), the lawful beneficiaries, through written consent, agree to appoint an administrator, who would then apply for a Letter of Administration (LA) through the High Court. Two administrators have to be appointed if minor beneficiaries are involved.

For estates with a gross value not exceeding RM2 million with properties, an application is made to the District Land Administrator for a Distribution Order whereas for an estate consisting of not more than RM600,000 of movables only, an application to Amanah Raya Berhad is made.

But this is only the first step. Additionally, two sureties are required by the High Court to provide security for the administration of the estate, unless an exemption is granted by the High Court. This combined security shall be equivalent to the gross estate value.

According to the law, when there is no will, wealth is distributed according to this formula: a quarter to the spouse, a quarter to the parent(s) and half to the child(ren).

Or if the parents are no longer around, one-third goes to the spouse and two-thirds to the child(ren). In this instance, the deaths of the parents have to be proven through their Death Certificates, which could be a hassle if they passed away many years ago. A lawyer would then have to be engaged to extract the certificates from the National Registration Department.

What is a Will?

- Is this a valid and functional will?

- Are my instructions in the will clear for my executor to understand and carry out?

- Does it achieve my objectives?

- How can I ensure that there is no tampering to my will upon my demise?

If there is any doubt to even one of these questions above, it is better to engage a professional estate planner or a lawyer who has the know-how to close all these loopholes.

Muslims also can have a will done, appoint executor(s) and/or guardian(s) in the will. Muslims can give one-third of their estate to non-heirs under Islamic law and the remaining two-thirds inherited by Faraid heirs.

A Muslim may choose to distribute all his assets to the Faraid heirs or to particular Faraid heirs only with the consent of all Faraid heirs or to the Faraid heirs equally, again with the consent of all Faraid heirs.

Upon a Muslim’s demise, the appointed executor will simultaneously apply for the Sijil Faraid through the Syariah court for Faraid distribution and the Grant of Probate from the High Court.

Appointing an Executor

Under the law, only one executor is required to be appointed in the will. However, through experience, Peter Lee advises that at least two be appointed, arranged according to priority, in the event that the first executor is unwilling or unable to carry out the duties. A testator is allowed to appoint up to four executors.

For the substitute executors of separate wills of a husband and wife, it would be better to have the same person appointed, in the event of a common disaster. If different people were appointed, these two parties would have to work together and at the same pace to execute the two wills.

The executor is someone who is at least 21 years of age and trustworthy in the eyes of the testator. His (or her) role would be to apply for the Grant of Probate from the High Court in the event of the testator’s death. He (or she) may need to engage a lawyer to do so.

Once the probate is obtained, the executor, who is entitled to claim up to a maximum of 5% to the value of the estate, subject to approval of the High Court, for all his (or her) troubles, will obtain a court order to collect assets, such as savings from the bank, shares, mutual funds, unit trusts and land titles from the Land Office.

The executor will then put up a notification in the newspapers to creditors, if any, and only proceed with the distribution of net wealth according to the conditions inside the will, after a lapse of two months and all debts owed by the estate repaid. If the executor fails to settle a debt, such as personal income tax owed to the Inland Revenue Department after the wealth is distributed, he may have to bear it himself.

In the event that the beneficiaries are below 21 years of age, a guardian has to be appointed to care for the children. Similar to the appointment of an administrator(s) or executor(s), the guardian has to be carefully chosen because he or she will be the substitute parent. Although anyone above the age of 21 and capable of taking care of children can be a guardian, you would want someone whom the child already has a close relationship with.

Beneficiaries below 18 years old cannot receive assets. Under such circumstances, the executors would usually automatically become the trustees, and hold in trust for the estate.

The question is, what if the trustee passes away before his responsibility is over? In such a scenario, the executor of the trustee’s estate will also have to take responsibility of the trust. This execution of the executor’s will, underlines the crucial need to appoint a corporate trustee instead of an individual executor.

Appointing a Corporate Trustee

On the other hand, an individual is mortal, may not know what to do and may not have the time or the energy to carry out his role. It is a tedious task and many are not aware of their responsibilities. Learning the process of will execution along the way, they take more time than necessary in getting the will executed and wealth distributed.

In many cases, the next of kin have no knowledge about the existence of a will or that they had been appointed as the executor or do not know where the will is kept. An unprotected will is just as good as having no will at all.

When a corporate trustee is appointed, usually the testator is given an asset inventory book to list down all his assets which he will keep himself, and custody cards, one for the testator himself and one for his executor.

Therefore, the executor knows whom to contact in the event of the demise of the testator.

Testamentary Trust

In layman’s term, this is a condition stipulated inside the will when beneficiaries are minors or have special needs.

With the objective of progressive distribution of wealth and the preservation of assets, stated under this condition include the amount of monies to be paid out as living expenses, for medical care and education every month, and for the duration of this condition. For example, until the youngest child attains the age of 18 or for a lifetime, in the case of a beneficiary with special needs.

The appointment of caregiver and/or guardian is also stated here.

Size Doesn’t Matter

There is a misconception that only the wealthy need to have a will drawn up. In estate planning, the size of it is immaterial, unless one totally has nothing. The average adult would have at least some savings in the bank, jewellery, a car, a house, shares in their business and also some small investments such as stocks and unit trusts.

As such, it is better to plan the distribution of these in the will for assets to be passed down smoothly to the next of kin. But in cases of special needs of dependents and minors, it is best to set up a living trust (inter vivos).

A living trust (inter vivos) is where the creator of the trust, called a Settlor parks his assets in the trust (which is managed by a trustee, usually a corporate trustee) during his lifetime. With such a trust, the immediate financial and medical needs of his beneficiary will be taken cared of for the period of the trust. A trust would have the advantage of being useful in the event of the Settlor’s disability, as he may be the sole beneficiary during his lifetime. It can even be used in the event of the Settlor’s disappearance where assets are used for the dependents and children.

Those who would like to read about the importance of a will in real life scenarios can do so from Peter Lee’s book, “To Delay Is Human But To Will Is Divine”, written in an easy-to-read manner and light-hearted tone. It is available at the Ipoh Echo office, MPH Online, selected Popular bookstores, and Peter Lee’s office at No. 108 (2nd Floor), Jalan Raja Ekram, 30450 Ipoh. It is sold at RM28 a copy.

Peter Lee also writes a monthly column in Ipoh Echo. His series, “In The Name Of My Father’s Estate”, illustrates the importance of the will in a captivating family drama.